Net Revenue Retention is the key driver of returns in SaaS

A short essay on "durable growth."

The fine folks at Meritech Capital recently published a great post called Durable Growth and the Compounding Returns of Public SaaS Companies, which you should read yesterday. The chief takeaway:

For public SaaS companies, durable growth is the most important factor in long-term value creation. And while short-term dramatic market movements (as we have seen this year) can create or destroy significant value for companies, durable revenue growth over time will outpace negative changes in multiples and dilution. High share price returns in the public markets for SaaS companies are about time in the market vs. market timing. No surprise, the power of compounding is evident in public SaaS returns just like it is in anything else.

And:

The size of a company’s LTM (last-twelve-months) revenue at IPO has no relationship to returns.

Let’s translate that. If you want to make money investing in SaaS, it’s not enough to invest in the fastest-growers - because near-term growth is already priced into entry multiples.

That 50% growth (at scale) is nice, but you’ll have to pay up to buy it. This is not free alpha ready to be scooped off the sidewalk. Remember, we’re hunting for share price returns, not just growth for its own sake.

But why would long term (durable) growth be correlated with stock returns if short term growth isn’t? Let’s look at consensus revenue estimates for a few high-flying public companies. Here’s Snowflake:

And here’s Crowdstrike:

Let’s assume that these forward-looking estimates are roughly the investor consensus, i.e. if the company over-performs them, the stock will over-perform against whatever the mean discount rate is.

One thing you should notice is that these revenue projections represent a slowdown not just in future years compared to current performance, but current year relative to mid-year performance. Check out Snowflake’s actuals, and you’ll see that even though we’re halfway through the Jan ’23 fiscal period and running at an 83% growth rate, the street projection calls for only 67% growth this year and 52% next year (yes, I know comparing run rates and GAAP revenues isn’t exactly apples to apples, but the argument is directionally correct).

And now Crowdstrike. The market predicts 51% growth this year, and 36% next year, but year-to-date the company has grown 61%. (CRWD earnings come out in a couple of hours, by the way).

Companies are supposed to slow down at scale, and growth persistence is something that we can measure and forecast. So I don’t object to the forecasted deceleration. But what you should notice is 1) the market projects that these rather unique >$2B revenue 60-80% growers will turn into ho-hum 20-30% growers in the not-so-distant future; and 2) particularly the case with SNOW, the revenue growth rate is projected to fall below the NRR rate almost immediately.

To be more specific: SNOW reports a 171% net dollar retention rate in its most recent quarterly report, which means 71% growth coming from existing customers alone, yet the market expects the company to grow in its entirety (inclusive of net expansion and new customers) 67% this year and 52% next year. That means the market is expecting the company’s net expansion rate to seriously contract.

(It’s best not to be too exact about this: NRR at SNOW is calculated using a 2-year lookback, whereas ARR growth numbers are more recent, so it’s not accurate to say “71% of Snowflake’s current 83% growth is coming from existing customers”. It’s better to think of these things in terms of ranges and to skew conservative, e.g. “net expansion is probably accounting for somewhere between 50% and 70% of SNOW’s current growth”.)

Let’s contextualize this. It’s the street’s job to present conservative assumptions; after all, even the best companies eventually decelerate, no company can keep growing at 50%+ forever. But the market consensus is effectively saying “We don’t care that you’re currently growing >80% and that your net expansion rate is >170%, in 5 years you’ll be growing 30% and you won’t be able to keep either of those numbers anywhere where they currently are”.

This takes us back to the Meritech article. You can’t outperform the market merely by growing quickly this year or next year. But you can outperform the market by continuing to grow faster than the market expects in future years 2 through n.

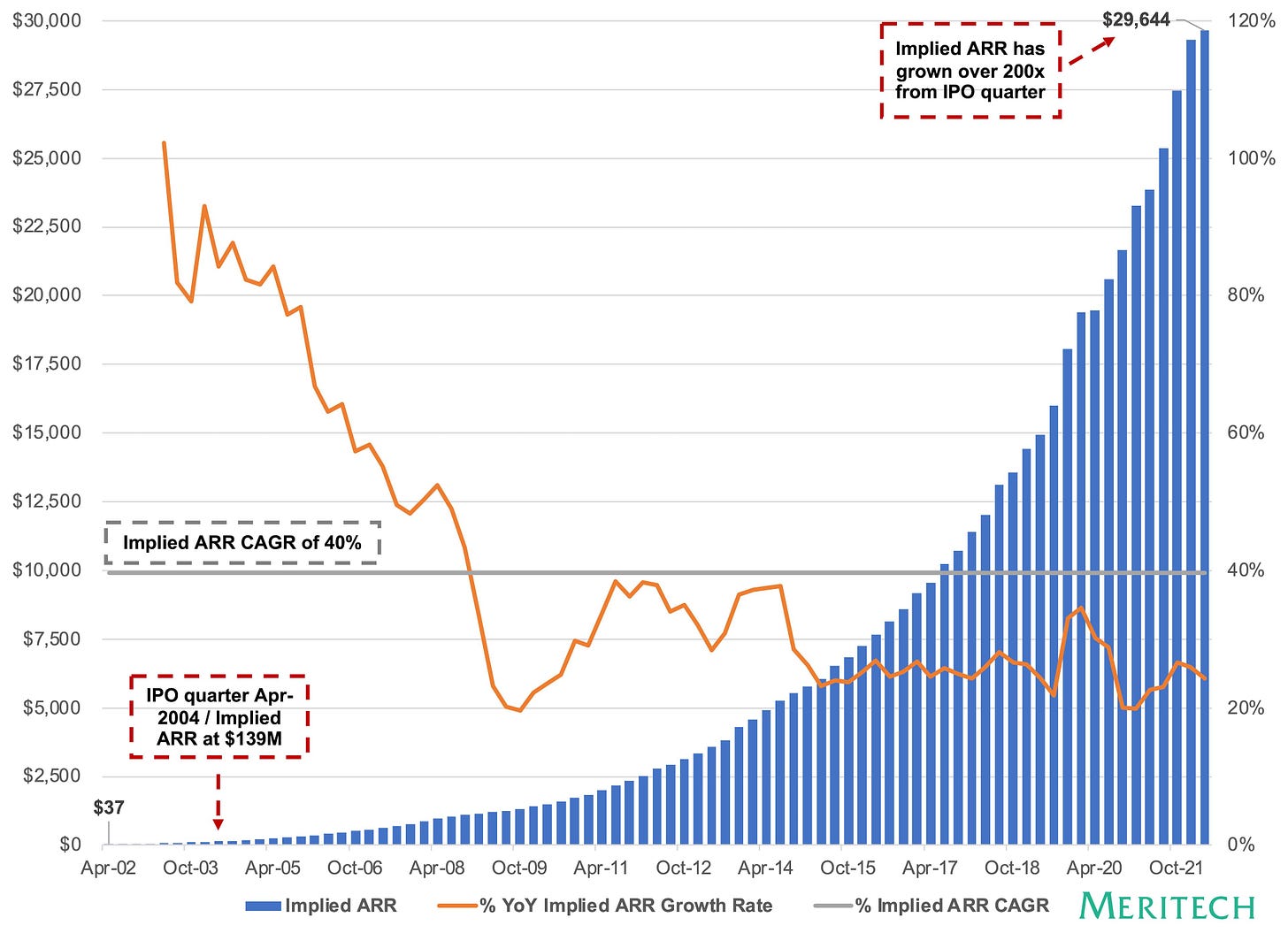

Look at the trajectory of Salesforce, which has returned something like 50x since its IPO. Salesforce went public while it was growing ~80%, this was totally knowable and already priced into the stock, as (likely) was the graduated deceleration of growth over the next few years. What was definitely not priced into the stock was the continued >20% growth rates all the way through 2021 and beyond!

So. Durable (persistent) growth is correlated with alpha, because markets do not believe that exceptional growth can continue unabated without massive deceleration (standard corporate finance says that in the long run, companies should grow at the same rate as GDP).

But what do we know as SaaS investors & operators? Net revenue retention acts as a floor on growth. As long as your net expansion rate is 130%, it’s really tough to grow your business by less than 30%, or something has seriously gone wrong.

We also know that the discipline of encouraging repeatable revenue expansion (from product-led growth, to customer success, to proactive account management, to consumption-based pricing, and so forth) has gotten way more sophisticated over the past decade or so. While NRR can’t stay extraordinarily high forever (a $100,000 account that expands at 70% annually would be worth $4,000,000,000 in twenty years), a SaaS company that constantly brings in new small/midsized accounts every quarter and reliably lands-and-expands them over time, without facing much logo churn, can keep up a 110-120% net dollar retention rate (i.e. 10-20% growth before accounting for new business) for a very, very long time. That’s enough to beat the expectations baked into any but the most optimistic market prices.

To summarize…

Durable growth is the most important driver of equity returns in SaaS. NRR acts as a “floor” on your growth rate in future years, thus providing growth durability. Therefore, optimizing for robust NRR allows us to achieve long-term superior returns, everything else held equal.

Now, what does this imply about what we should look for, as investors? And what to build towards, as operators?

Find companies with sticky products, i.e. high on a gross/logo retention basis.

Once the company has the customer’s attention and trust, look for a repeatable upsell motion that aligns value between the company and the client.

Don’t forget that before you can get big, you first have to avoid running out of money. As the Meritech folks wrote:

"One important caveat here: this analysis does not include the associated margins, cash burn, or overall efficiency of the group of companies in relation to their valuation multiples. Efficiency and strong unit economics are, of course, required if a company is to remain in the public markets for a long time. If you’re not efficient; cash will run low, you’ll be forced to raise dilutive primary capital and / or growth will be forced to slow, stock price can fall, and you may ultimately be acquired, removing you from the public markets and likely capping return potential in the process."

Significant disagreement on what constitutes "durable growth". Is fraud durable? Herbalife+Carl Icahn say yes, Ackman says no...