A Trump victory means workers get poorer but VCs get richer

Or: How I learned to stop worrying and endorse Kamala Harris

For unto whomsoever much is given, of him shall be much required: and to whom men have committed much, of him they will ask the more. Luke 12:48

Donald Trump is running a campaign to bring prosperity back to the working man and stick it to the out-of-touch globalist elites. Let's dive in and see just how true that really is.

A quick primer on tax rates: In general there are two categories of taxes on individuals, Ordinary income and capital gains. Income can be thought of as the tax on Labor, while capital gains are a tax on, well, Capital1. In startup terms, Labor is the employees performing daily work at the company, and Capital is the investment money that pays the bills and gets the whole company going. Labor has to show up to work to earn its keep, whereas Capital makes money while its owners sleep.

Historically speaking, anything in America that is proximate to Capital gets substantially favorable tax treatment compared to income from Labor. Currently the top marginal Federal tax rates are 37% for income and 20% for Capital gains. In the Trump plan this status quo largely continues, whereas the Harris proposal is a break from tradition by substantially removing benefits to Capital2.

Why does Capital historically get taxed at lower rates than Labor3? The rationale for this skew is that this encourages investment and therefore economic growth. Which is not untrue. But if one were more cynical he could say that another reason is that since the world's powerful people have more wealth than income, they lobby for policies that favorably represent their interests. If one were REALLY cynical, he could say that the truly wealthy encourage highly emotionally charged public arguments around income taxation (or even moral panics around transgendered athletes and immigrant rapists) to distract us from arguments we otherwise might be having about capital gains tax rates or the various methods that can be employed to drive them even lower.

This, of course, is the “rigged” economy that Trump himself is constantly ranting against. Kind of ironic that the Harris plan actually attempts to un-rig the economy in favor of Labor4, and the Trump plan makes it even more rigged towards wealth and power5, don’t you think? Bueller? Bueller?

Here's a few things you should know about the Capital class:

They have a greater ability to afford nice tax accountants, which means whatever opportunities are available to reduce their tax burden, they will find. They also have plenty of disposable income to get meetings with Important People and calmly explain why any additional taxation on Capital will lead to the Civil War Part II.

Because consumption (the everyday necessities they spend money on) represents a small percentage of their income, inflation has barely any effect on them. You think hedge fund managers give a shit how much a carton of eggs costs?

They are more mobile than the average citizen — it's within their means to migrate to a low tax state like Texas or a low tax country like Singapore. This means that if their state or country deficit spends its way into fiscal insolvency, they have a greater capacity than average to make that not their problem.

Let's see how the Harris and Trump economic plans stack up for Capital and Labor:

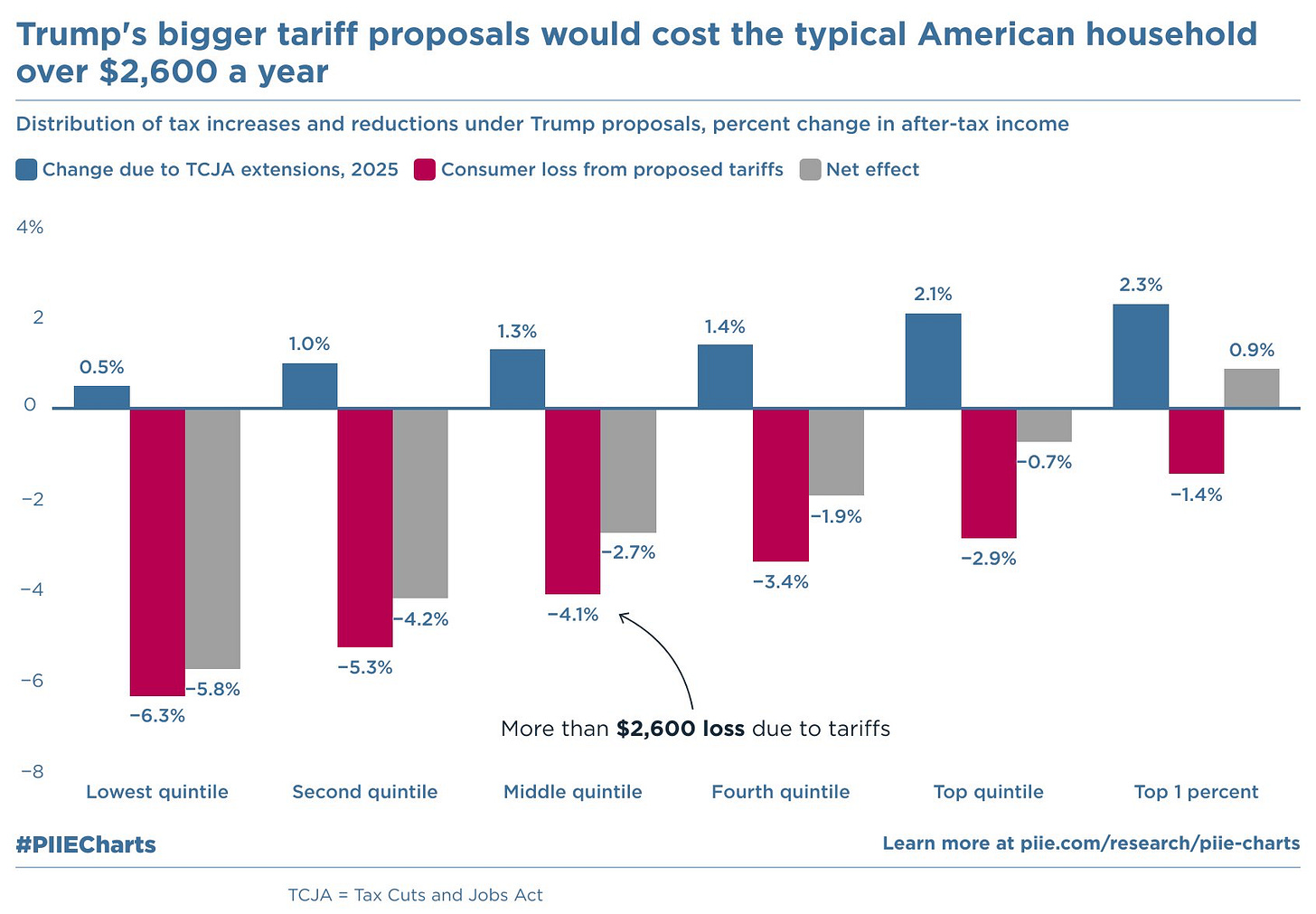

Trump's plan is all about deficits, inflation, and taxes on low income Labor in the form of tariffs6, all to fund the continuance of gigantic tax breaks to Capital. This is before we even get to the parts about repealing Obamacare (read: remove benefits for the working poor) and forcefully reducing interest rates to increase asset prices (remind me who owns all the assets again?). All in all this is Capital's wet dream.

Trump drapes himself in the language and customs of the working class, and all of his rhetoric has to do with uprooting the corruption supposedly caused by liberal Democrats and their Deep State friends. But then why is he fighting so hard to take money from the working class people who take off work to show up at his rallies, in order to hand it gift-wrapped to the Capital class7?

The answer, as far as I can tell, is that he's a con artist.

"It's called a confidence game. Why, because you give me your confidence? No: because I give you mine."

A con artist lowers his mark's defenses by giving them something of symbolic (read: pretend) value, and then he swipes something of actual economic value from them when they're not looking. In House of Games, the con artist (Mike) gives Margaret the appearance of his trust, and then once her guard is down he proceeds to steal her life savings. In Trump-land, Trump gives his followers the impression that they're draining the Swamp, and then while they're busy cheering "Komrade Kamala!" he robs them blind and cuts The Swamp a check.

Let me state this as clearly as I can because it's so important: His followers get to enjoy the pleasure of calling my fellow progressive Democrats "cucks" and "libtards" on Twitter, and then literally are forced to give Capital-class fund managers (like me) more of their money. Why? Because Trump was Capital all along. That’s the con.

VP Harris's plans to address the issue of wealth inequality certainly have their flaws. The proposal to tax unrealized gains, for example, is pretty ham-fisted. The Democratic Party doesn't have an unimpeachable record when it comes to economic theory. And there's plenty about Harris's long public career to find fault with if you wanted to. But do you know what she's not doing? She's not screwing over regular working people while pretending to be their friend. And that's why she's earned my vote.

I am capitalizing Labor and Capital to draw a distinction in the way that Piketty would. Or Marx, I guess.

Note that these are the proposed highest marginal tax rates -- this is not the effective rate that 99% of citizens would be charged on gains to their personal investment portfolios.

The question of "why is this question asked so infrequently in the press?" is left as an exercise for the reader.

To be very explicit about the irony: Almost everyone in the crowd at a MAGA rally is Labor.

Before you object that I'm some kind of communist, let me remind you that I've spent the last 2/3rds of my career in venture “Capital”. I think wealth is great and I hope we get even more of it. This post is about not about wealth being bad, it’s about what happens when the working class is tricked by hucksters into impoverishing itself.

The question of "does this theory still make sense even though Trump has no idea how tariffs work?" is also left as an exercise for the reader.

We also know that, demographically speaking, large owners of Capital are more likely to have advanced degrees, live in big coastal cities, tolerate LGBT rights, support access to abortions, and not be too concerned by illegal immigration. At least from a sociocultural standpoint, the people who run the world are Democrats.

Welp, a few people have pointed out to me that I completely missed Harris walking her proposed cap gains rates down to 28% (33% after a 5% investment tax) a few days ago: https://www.wsj.com/politics/elections/kamala-harris-to-pare-back-bidens-capital-gains-tax-proposal-14c537b1?st=lvmcubofm4dbqpf&reflink=article_copyURL_share. That would change the math here somewhat (though not entirely). We'll see what happens. Thanks to everyone who let me know... this is what I get for spending a few days heads down copy-editing.

An entire discussion of taxation policy without any discussion of how the money is spent just comes across as punitive: we should tax capital more because rich people are bad. It’s not very insightful.

If you would like to be taxed more, the IRS accepts donations.