If you believe in the SaaS business model, now is the time to buy growth stocks

This is not investment advice.

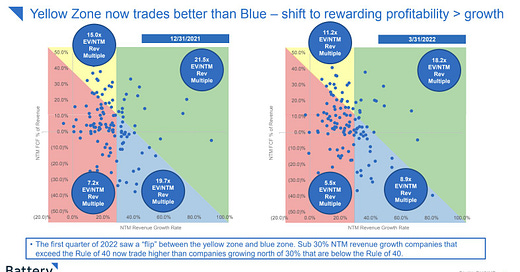

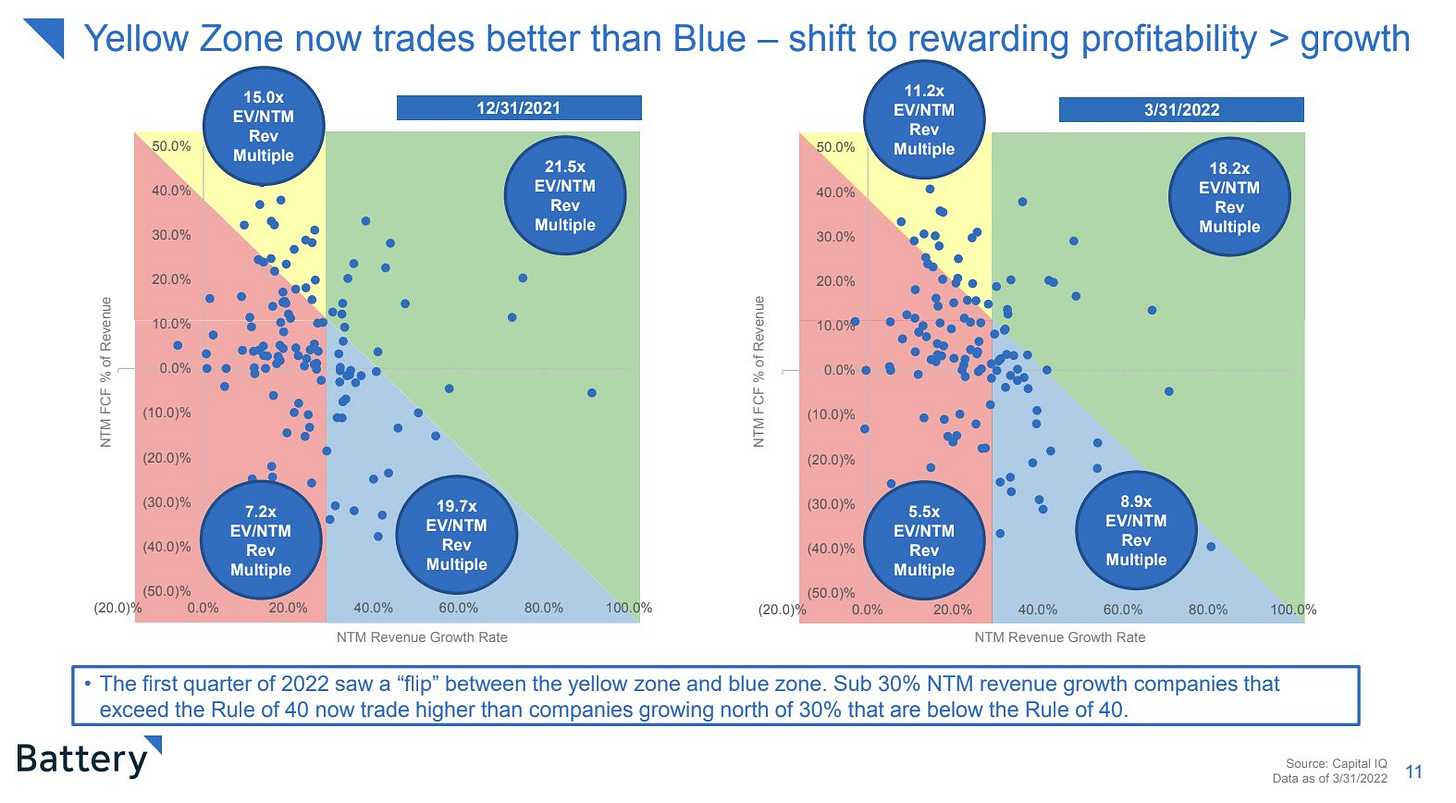

While skimming Battery’s excellent Q1-22 Cloud Quarterly report I came across the absolutely beautiful slide that I’ve reposted above.

What Battery does here is break the public SaaS market into four quadrants:

The green quadrant: Companies above the Rule of 40 that also have 30%+ growth (ex: Snowflake, SentinelOne, Datadog, Crowdstrike)

The blue quadrant: Companies below the Rule of 40 that also have 30%+ growth (ex: Monday, Asana, Amplitude, Confluent)

The yellow quadrant: Companies above the Rule of 40 with growth less than 30% (ex: Atlassian, ServiceNow, Adobe, Salesforce)

The red quadrant: Companies below the Rule of 40, including growth of less than 30% (ex: DocuSign, Coupa, Zendesk, Procore) — this grouping also happens to have around as many companies as the other 3 groups all put together

… and show what the NTM revenue multiples were for each category on 12/31/21 and on 3/31/22. (Multiples have come down even further in Q1 but roughly in line with what happened in Q1, so this Q1 report will suffice to demonstrate the general trend.)

As is easy to see, multiples have come crashing down since the start of the year; this has happened across the board (in all 4 quadrants) but most steeply in the “high growth but not yet profitable” category (the blue quadrant), which has been absolutely slaughtered in Q1 (from 19.7x to 8.9x NTM revenue multiple).

The weird part

I’d like to point out something that’s actually very strange — take a look at how the blue quadrant compares to the yellow quadrant. As of 3/31 (and in contrast to 12/31), blue companies began trading at a lower multiple than yellow companies, despite the fact that they are growing significantly faster than yellow companies. Given that revenue growth and valuation multiple are positively correlated, this should surprise us — for this to be true, markets must now be privileging today’s free cash flow so much greater than tomorrow’s growth that a 20% grower with 30% FCF margins commands a higher multiple than a 50% grower with negative-20% FCF margins. I’ll repeat: A 20% grower can trade at a higher revenue multiple than a 50% grower if it can show positive cash flows now.

That hasn’t really been the case at any point in my (admittedly post-GFC) investing career — in general, high growth has traded at high multiples even while losing money, because investors presumed that SaaS revenues were durable and would lead to profits in future years (more growth now means more future profits later). But the world has changed, as has the narrative — we’re seeing a “rotation to quality”, “the death of growth at all costs”, and so forth. Even though this state of affairs would be seriously bizarre in 2018 (and flabbergasting in 2021), maybe it makes sense. Mr. Market is effectively saying “you’re a growth-at-all-costs company until proven otherwise — show me profits now or else."

But here’s the thing.

If you believe the blue category is just a bunch of “terminally unprofitable Ponzi shitco’s" (as I see repeated constantly on Twitter), well OK, then yes they should trade at a lower multiples until the companies can prove out their business models.

But is the SaaS model really unproven? Do we really doubt that these businesses can show profits at scale? Or, do we believe that blue companies are just yellow companies in the making?

If we believe in the long term economics of the SaaS business model, and if we believe that subscription software businesses with sticky products eventually convert growth into profits, and if we are long term investors (rather than speculators), then we should be buying SaaS growth stocks right now, because these stocks are currently on sale. They’re not just on sale at this year’s revenue multiples, they’re very much on sale at next year’s multiples, and they’re extremely on sale at 2024’s multiples.

It strikes me that you’d have to be so pessimistic about the long term profitability of high growth SaaS businesses to avoid the blue zone given the current pricing. And if you’re that pessimistic about the SaaS business model, why are you investing into the sector at all?

Great write-up, Pat. For argument's sake, will take the other side:

1/ Can't pay fixed charges with ARRs. Mr. Market is clearly stating that in a recessionary environment FCF positive operators should be valued at a premium vs. those with a potential to get there. You say buy the blue b/c it's going to green, but the market is saying the blues haven't yet figured out how to convert to revenue to cash (likely since their APE is too low vs. cash burn) and we are not certain that they ever will (e.g., they are more likely to become red vs. green).

2/ If you are institutional/patient capital, why not wait 1 (or 2 or 3...) more quarters and see if valuations continue to slide, given macro? Decent chance we aren't at the bottom yet (pg. 4, bottom tables), so would expect valuations to continue to deflate, making a more attractive bargain to come in later. For ex., the % of companies in the >30% NTM growth is the same in Q1'22 vs. FY'21 (pg. 3), but fewer of them (13) are growing at a 40% growth rate than just 1 quarter ago (17). Sometimes being too early (and correct) is not too far off from being wrong.

IMO, a fairer question should be not whether we should be investing in SaaS growth (personal/biased view is a resounding "yes"), but how much we should be willing to pay for it. Top of pg. 4 is helpful. >40% NTM growth aside, all categories of growth SaaS are now "cheaper" vs. what they were in '19 and almost as "cheap" as what they were in '17. So, what's the right attachment point? As always, DYODD :)

Would love to see a version of that Battery slide with the companies labelled (especially in the blue zone) - do you know if that exists?